Unlock Exclusive Conveniences With a Federal Cooperative Credit Union

Federal Lending institution provide a host of special advantages that can substantially affect your monetary health. From boosted cost savings and checking accounts to reduced rate of interest on finances and customized monetary preparation solutions, the benefits are tailored to assist you save cash and accomplish your financial goals much more effectively. But there's even more to these advantages than simply financial benefits; they can additionally give a sense of protection and neighborhood that goes beyond typical banking solutions. As we explore even more, you'll discover how these unique advantages can really make a distinction in your financial journey.

Subscription Qualification Criteria

To end up being a member of a federal lending institution, people must satisfy specific eligibility criteria established by the institution. These criteria vary depending on the specific cooperative credit union, but they frequently consist of elements such as geographic location, work in a particular sector or firm, membership in a particular organization or association, or household relationships to existing members. Federal cooperative credit union are member-owned monetary cooperatives, so qualification demands are in place to make sure that people who sign up with share a common bond or organization.

Improved Savings and Inspecting Accounts

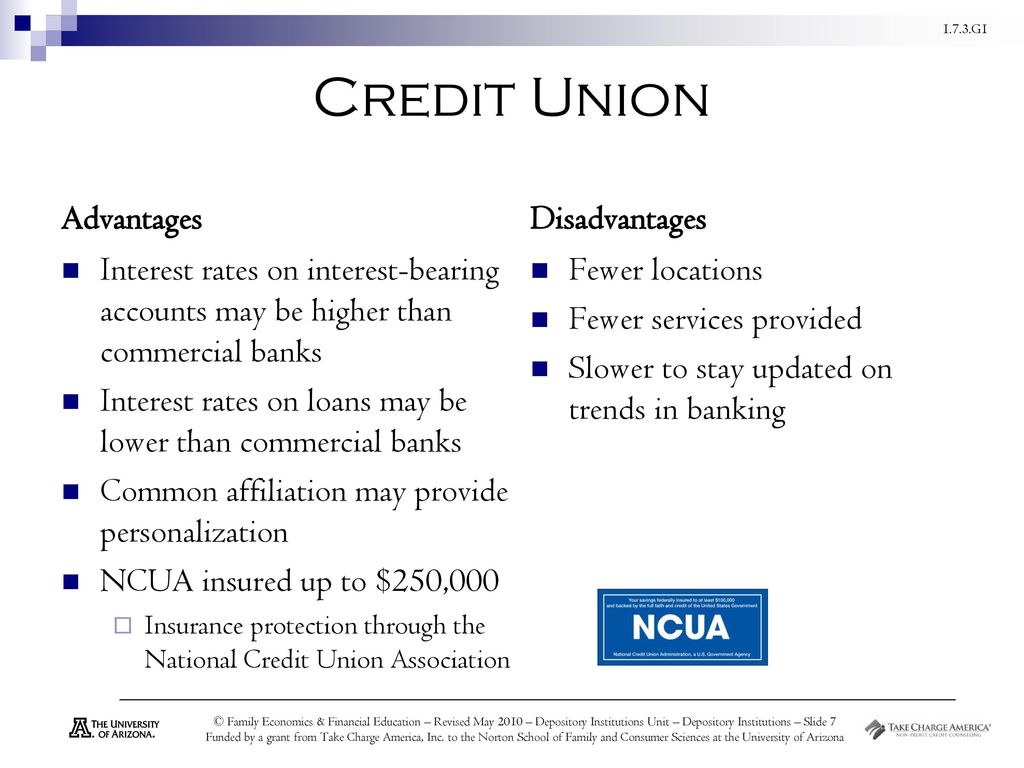

With improved savings and checking accounts, government credit history unions offer members exceptional financial products made to enhance their cash administration approaches. These accounts often include greater rate of interest on cost savings, lower costs, and additional benefits contrasted to conventional financial institutions. Participants can appreciate functions such as competitive dividend rates on interest-bearing accounts, which assist their money expand faster with time. Examining accounts might use perks like no minimum balance needs, totally free checks, and ATM charge reimbursements. In addition, government lending institution generally supply online and mobile financial services that make it practical for members to check their accounts, transfer funds, and pay expenses anytime, anywhere. By utilizing these improved cost savings and inspecting accounts, members can maximize their financial savings potential and successfully manage their everyday financial resources. This emphasis on offering costs financial products establishes federal lending institution apart and shows their commitment to assisting participants achieve their economic objectives.

Reduced Rates Of Interest on Car Loans

Federal credit score unions offer members with the benefit of lower rates of interest on loans, allowing them to borrow cash at more budget-friendly terms compared to other economic institutions. This advantage can lead to substantial financial savings over the life of a funding. Lower rate of interest suggest that borrowers pay less in passion costs, minimizing the total expense of loaning. Whether members need a lending for an auto, home, or individual costs, accessing funds with a federal lending institution can result in much more desirable repayment terms.

Personalized Financial Planning Solutions

Given the emphasis on enhancing participants' financial health with lower interest rates on car loans, federal lending institution additionally supply individualized economic planning solutions to help people in click over here now achieving their long-term monetary goals. These customized services accommodate participants' details needs and scenarios, offering a customized technique to economic preparation. By evaluating earnings, possessions, expenditures, and obligations, government lending institution financial planners can assist participants create a comprehensive economic roadmap. This roadmap might consist of approaches for conserving, spending, retired life preparation, and financial obligation monitoring.

In addition, the individualized economic preparation services offered by government credit unions frequently come with a reduced expense compared to personal financial advisors, making them more obtainable to a broader variety of individuals. Members can take advantage of expert advice and expertise without sustaining high costs, straightening with the credit scores union approach of focusing on participants' economic well-being. Overall, these solutions objective to empower members to make informed financial decisions, build wealth, and secure their monetary futures.

Accessibility to Exclusive Participant Discounts

Members of government lending institution delight in exclusive accessibility to a series of participant discounts on various products and services. Credit Unions Cheyenne WY. These discounts are a useful perk that can assist members conserve cash on daily costs and special acquisitions. Federal lending institution usually partner with stores, service providers, and other businesses to supply discount rates specifically to their participants

Members can benefit from price cuts on a range of products, including electronic devices, clothing, travel plans, and much more. On top of that, services such as cars and truck leasings, hotel bookings, and home entertainment tickets might also be available at reduced rates for lending institution participants. These special discount rates can make a substantial distinction in participants' budget plans, allowing them to appreciate financial savings on both crucial items and deluxes.

Final Thought

To conclude, joining a Federal Cooperative credit union provides see page many advantages, consisting of enhanced cost savings and examining accounts, reduced rate of interest on loans, personalized financial preparation services, and access to exclusive participant discount rates. By ending up being a member, people can gain from a series of financial rewards and solutions that can assist them save cash, prepare for the future, and enhance their ties to the regional community.